Remember all that exciting chatter from Linda S. Law about wanting Elm Court to “shine a bright light globally, and be a beacon for Lenox, Stockbridge and the entire Berkshire region.”

Elsewhere she promised, “It is something that will be remarkable for the community. It’s something that is very special and no one else has thought of. I think that we don’t need another wellness and health spa, I can tell you that. Even though everyone wants to do health and wellness, we’ve got plenty in the community. We’re looking at some interesting alternatives. My background has always been in public-private partnerships, always. It has to make everyone happy. But of course, that never happens. But I want both sides happy, not just one.” Law added, ‘I think what we’re cooking up is going to be a killer.’ “ On and on the hype machine churned, while Ms. Law lowered a thick cone of silence between the rotting mansion and the neighborhood in which she intends to do business.

That statement was made in the winter of 2023; yet now, a mere two and a half years later, Ms. Law is singing a rather more familiar song, as recorded in the pages of Town & Country magazine:

“The historic Vanderbilt Berkshires Estate, also known as Elm Court, will soon be a five-star resort. The great-grandson of George Vanderbilt, John Cecil, and real estate developer Linda Law plan to transform the 55,000-square-foot mansion and its 89-acre grounds into a luxury destination with 78 guest suites, 48 individual lodges, and 38 cottages. The project, they say, will preserve the Gilded Age property’s architectural character while introducing more wellness-focused hospitality.”

Wow, what a killer idea! A luxury wellness resort! Who would ever have thought of that? Well, for those with somewhat longer memories, such was the Travaasa vision, as well. Alas, they were unable to find investors willing to add yet another wellness resort to an already saturated Berkshires market. We will save further comment on the market for wellness resorts for another day. We would love to type out the headline:

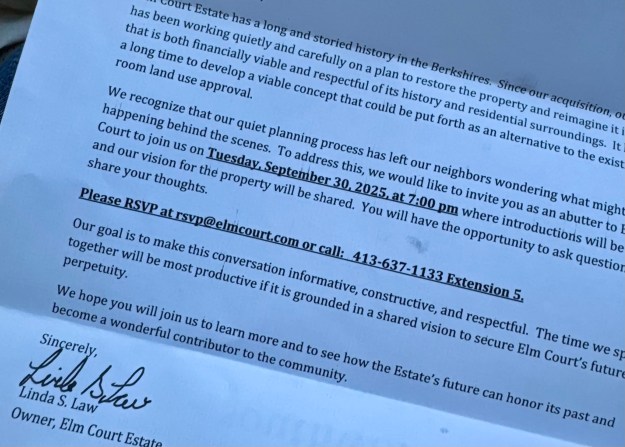

Elm Court Owner Finally Reaches Out To Neighborhood

We won’t hold our breath.

*******

In stark contrast, farther south on Old Stockbridge Road, the former Lenox Hunt Club at Overlee, now the Hillcrest Center, has changed hands. The first action (at least from our perspective) from new owner Joseph Shapiro? He reached out to the neighborhood, inviting input and dialogue regarding his plans for a small resort. He listened carefully and with respect.

Whatever doubts we might have about longterm economic viability for the plan, we welcomed Mr. Shapiro’s open, transparent and sincere efforts to be a good member of our shared neighborhood, in harmony with our distinctive & historic character. He was attentive to concerns about lighting, traffic and noise and will work with neighbors to find the best possible way forward.

Since Mr. Shapiro has committed to support and respect our right to the free & peaceful enjoyment of our properties, we will support his vision for a rejuvenated mansion, with renovated dorms providing quality onsite housing for staff. Welcome to Old Stockbridge Road, Joe!

*******